5 Strategy How To Start An Ira Account - Method 1method 1 of 2:comparing traditional & roth ira's. Unlike a roth ira, there are no annual income limits.

Lower Your Taxes and Start Investing by Opening a . It is possible to open an individual retirement account (ira) for a child.

Lower Your Taxes and Start Investing by Opening a . It is possible to open an individual retirement account (ira) for a child.

How to start an ira account

9 Successful How To Start An Ira Account. Can i start a roth ira with $ 200? A child must earn their own income in order to open an ira. The less good news is that some providers require a minimum account to start investing, so if you only have $ 50 or more, find a provider that doesn’t need it. How to start an ira account

The easy answer is $0, but that won’t get you on your way to growing your money into retirement. Like a roth ira, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4 thats where the similarities end. Quite simply, an individual retirement account or ira is a retirement savings account. How to start an ira account

The truth is, you can start an ira with very little money. Let’s demystify what it’s like to start investing later in life. The irs doesn't require a minimum amount to open an ira. How to start an ira account

The size of your contributions will depend on the amount you need to save in order to live comfortably once you stop working. An individual retirement account, or ira, is one of the best places to save for retirement — the tax benefits can give your savings a nice. With an ira, anyone with earned income can get one, and you How to start an ira account

For 2021 and 2022, the cumulative max ira contribution you can make to all your ira accounts is $6,000, or $7,000 if you’re 50 years old or older. You must call us at the numbers indicated below to request a distribution from your ira — be sure to have your account number(s) handy. After you’ve decided that you want to make saving a priority, you’ll need to think about how much you want to invest. How to start an ira account

If you want to open a roth ira in a bank and / or credit union, you may be limited to only savings and cds as your investment options. Contributions may be tax deductible for single tax filers earning less than $76,000 magi ($75,000 for 2020) footnote 2. Choose an all in one fund or customize your portfolio. How to start an ira account

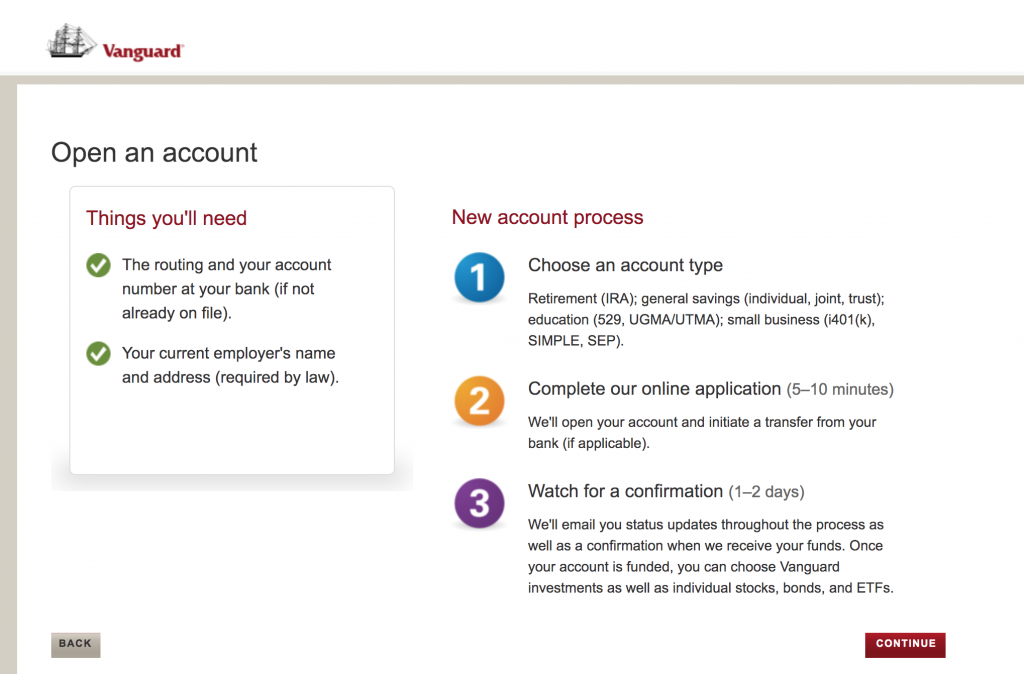

Open a traditional ira “the easiest way to get started with a retirement account is to set up an ira,” says dan sudit, partner at crewe advisors in salt lake city. Start simple, with your age and income. You'll need your personal information following the checklist above learn more. How to start an ira account

Keep it simple with an all in one fund. Learn the basics of an ira. If you have a job with benefits, your first step should be to call up your hr manager and ask if you have a 401 (k) plan or similar retirement savings plan at work. How to start an ira account

But keep in mind that there are contribution limits. Starting a retirement account now can go a long way toward building a vital nest egg. An ira is a personal account you can use to save for retirement. How to start an ira account

Follow these steps to help you make your decisions and open your new ira. An ira, or individual retirement account, is a personal investment Maximum ira contributions can change from year to year. How to start an ira account

The keys to really take advantage of the power of roth iras or traditional iras are to understand your eligibility, the rules, and to consistently add to your account over time. In addition to your ira, you should open a retirement account with your employer if they offer one, such as a 401(k). Decide which ira suits you best. How to start an ira account

However, some providers do require account minimums, so if you've only got a small amount to invest, find a provider with a low or $0. Note that you may be able to contribute to both an ira and your company’s 401 (k), or other employer sponsored retirement account. If you’re in the middle of your career and wondering, we’ll cover how to play catchup. How to start an ira account

Opening an individual retirement account (ira) is an important way for you to start funding a comfortable retirement and to help prevent. Ira stands for an individual retirement account and it is considered the safest and most effective investment. Additionally, if they offer an employer match, you should contribute at least that much to your retirement account. How to start an ira account

Then compare the ira rules and tax benefits. Contributions may be tax deductible for joint tax filers earning less than $125,000 magi ($124,000 for 2020) footnote 2. If so, sign up to have a small amount saved from your paycheck each week. How to start an ira account

Anyone who has earned income equal to or greater than their ira contribution is eligible. How to start an ira account

Why now is the right time to start a Roth IRA Telos . Anyone who has earned income equal to or greater than their ira contribution is eligible.

Why now is the right time to start a Roth IRA Telos . Anyone who has earned income equal to or greater than their ira contribution is eligible.

How To Start A Roth IRA In 5 Steps FortuneBuilders . If so, sign up to have a small amount saved from your paycheck each week.

How To Start A Roth IRA In 5 Steps FortuneBuilders . If so, sign up to have a small amount saved from your paycheck each week.

How To Start An Ira Account Start Choices . Contributions may be tax deductible for joint tax filers earning less than $125,000 magi ($124,000 for 2020) footnote 2.

How To Start An Ira Account Start Choices . Contributions may be tax deductible for joint tax filers earning less than $125,000 magi ($124,000 for 2020) footnote 2.

Infographic How To Invest In A Roth IRA . Then compare the ira rules and tax benefits.

Infographic How To Invest In A Roth IRA . Then compare the ira rules and tax benefits.

How To Start A Roth IRA In 5 Steps A Beginner's Guide . Additionally, if they offer an employer match, you should contribute at least that much to your retirement account.

How To Start A Roth IRA In 5 Steps A Beginner's Guide . Additionally, if they offer an employer match, you should contribute at least that much to your retirement account.

How To Start A Rollover IRA Account? Inside Your IRA . Ira stands for an individual retirement account and it is considered the safest and most effective investment.

How To Start A Rollover IRA Account? Inside Your IRA . Ira stands for an individual retirement account and it is considered the safest and most effective investment.

Comments

Post a Comment